The Lost Art of Early Stage Venture Capital

Venture capital investments have been on a sustained run (minus a couple blips here and there) for the last decade-plus. However, over the last several years, beginning in around 2014, there was a clear inflection in the types of deals getting done and the types of funds being raised — in short, bigger was perceived to be better.

From 2009 to 2013, the average deal size consistently ranged from $5.1–6.7M. It’s seen a sharp increase from 2014 onward, though, peaking at $13.3M in 2018 and a similarly high $12.7M last year. More importantly than simply looking at average deal size regardless of stage, so-called “mega-deals” have been setting new records annually in both early and late stage venture. Early stage “mega-deals” grew 488% from 9 in 2014 to 53 last year, while total “mega-deals” (i.e. including late stage ones that are more inclined to be large on a relative basis) grew 182% from 84 in 2014 to 237 last year.¹

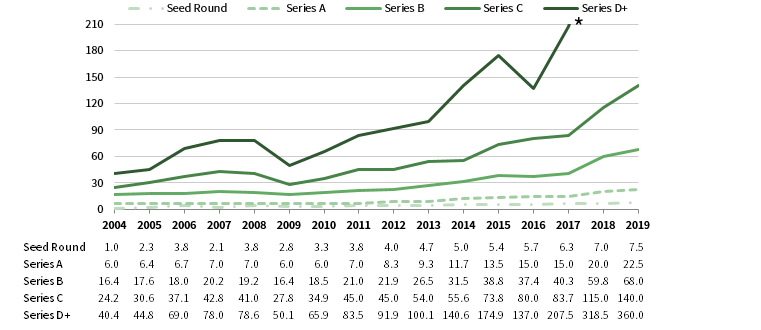

Median pre-money valuations have also increased more dramatically from 2014 onward than from 2009 to 2013 (see chart below).²

From 2009 to 2013, median pre-money valuations increased 67.9%, 55.0%, 61.6%, 94.2%, and 99.8%, respectively, across the 5 investing stages broken out above. From 2014 to 2019, though, median pre-money valuations increased 50.0%, 92.3%, 115.9%, 151.8%, and 156.0%, respectively, across the same 5 stages with seed, notably, being the only one that has not experienced an accelerated increase during this period (more on that below).

These dramatic increases in deal size and valuations are a function of a few interconnected trends:

- Founders’ and investors’ fairly misinformed belief that capital is a moat

- A massive influx of LP capital, particularly from new investors in the asset class and those seeking more exposure to it

- More venture investors of all types leading to more competition and driving up valuations (i.e. basic supply and demand dynamics)

- At the later stages (Series D+), companies raising larger private rounds rather than going public

- Venture fund sizes dramatically increasing (in part to meaningfully invest in late stage / pre-IPO rounds and in part to generate more fees), thereby needing to make larger investments with very fixed ownership targets to make their fund math work out, even at the Series A and Series B stages

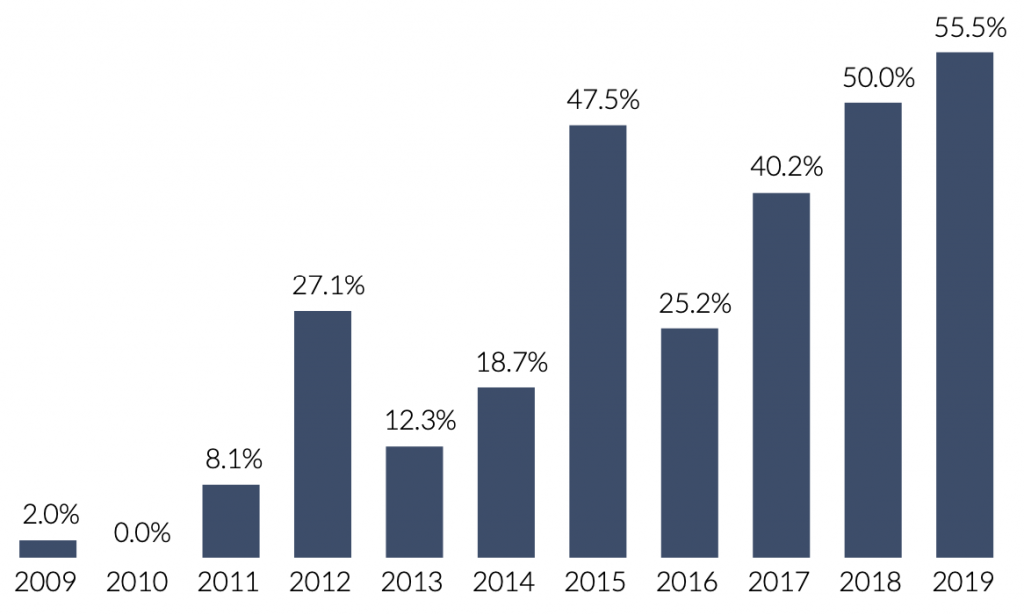

This last point has played out as median size fund step-ups have grown at a significantly higher rate from 2014 to 2019, particularly 2016 onward, than they did from 2009 to 2013 (see chart below).³

Overall, an increasing number of traditionally early stage firms have gravitated towards becoming “agglomerators” (h/t Nikhil Basu Trivedi and Kanyi Maqubela) and borderline asset managers, have raised significantly larger funds in a short period of time in order to become multi-stage / stage-agnostic, or have raised other investment vehicles to enable their ability to invest at the growth stage and beyond, a strategy that I think makes the most sense for investors, founders, and LPs if you feel the need to participate in growth and late stage venture rounds. Larger fund sizes and a need to make larger investments to make the math work has led to firms having the perceived luxury of waiting for more proof points from companies before deciding to make an initial investment. Meanwhile, a relatively small number of firms have kept fund size and strategy in check during this period when they could have certainly raised funds that are multiples larger based on track record and LP demand.

My belief is that true early stage venture capital (investing in companies that are raising at pre-money valuations between roughly $5M and $30M) is executed best when fund sizes are kept to reasonable levels. You should invest as early as you have conviction and as frequently as you can thereafter to build positions in companies over time. Investing early and often, rather than feeling compelled to wait for a round that is dictated by an inflated fund size, has a number of advantages.

Employing this strategy allows funds to deploy a meaningfully smaller amount of capital (~60–70% less) over two to three financings to reach a target ownership than funds that try to get that same level of ownership with a single investment at that third financing. The earlier investor can also avoid competing in “winner-take-all” financing rounds where there is typically just one new investor, a dynamic that can often drive up valuation. Moreover, an existing investor gets to make highly educated decisions at each successive financing, whereas the new investor is at a distinct disadvantage when it comes to doing diligence. If executing proper portfolio management, the insider should know when it makes sense to follow on aggressively (or not) or when to pre-empt (or not) and have a deeper understanding of how that company is performing than the new investor who is parachuting in to invest for the first time. [Quick tangent on follow-on underwriting: Each subsequent investment after your initial one should be more informed than the prior investment in a company. It should treated as if it’s a de novo investment and underwritten “from scratch” to determine what percentage of your pro rata allocation you are going to invest. In all likelihood, you probably want to own more or less of that company, so simply treating doing your pro rata as the default may not be the best approach.] I believe that executing the strategy outlined above allows you to keep fund sizes in check, which allows managers to better align incentives with LPs and founders, the two constituencies that matter most to them.

Ultimately, this approach, particularly the aspects around thorough re-underwriting of investments and investing often (i.e. pre-empting rounds, getting creative with follow-on structures, and ensuring meaningful allocations when they’re desired) is easier said than done. However, it is certainly possible to execute this strategy, and I believe a lot of it comes down to mindset / approach and active portfolio management — not just investing. It requires knowing how well every company is performing against plan and in the context of the broader market (startup ecosystem and its particular sector); having transparent, communicative, and strong relationships with founders you’ve backed; and having a sufficiently large reserve pool to execute this approach while investing early enough to get meaningful exposure to companies and the ability to track them closely over the course of multiple subsequent rounds. It is a strategy that some of the best early stage venture capitalists still execute today, but increasingly, it feels like a lost art.

- Pitchbook and NVCA, Venture Monitor (Q4 2019)

- Cambridge Associates, Venture Capital Positively Disrupts Intergenerational Investing(January 2020)

- Pitchbook and NVCA, Venture Monitor (Q4 2019)